If you think the typical saas-bahu audience may not be the right target for your premium messaging, here’s something that might change your mind. We ran a study on Top viewed Hindi GEC shows on Zapr’s TV-to-Mobile platform and found that the same viewers watched a lot of premium content on news and sports channels. Data reveals that their mobile handsets lean towards mid and high-end device brackets strongly suggesting high-spending patterns.

For media planners, is this a perfect audience mix of Hindi GEC’s deep-domestic penetration with significant affinity to premium content?

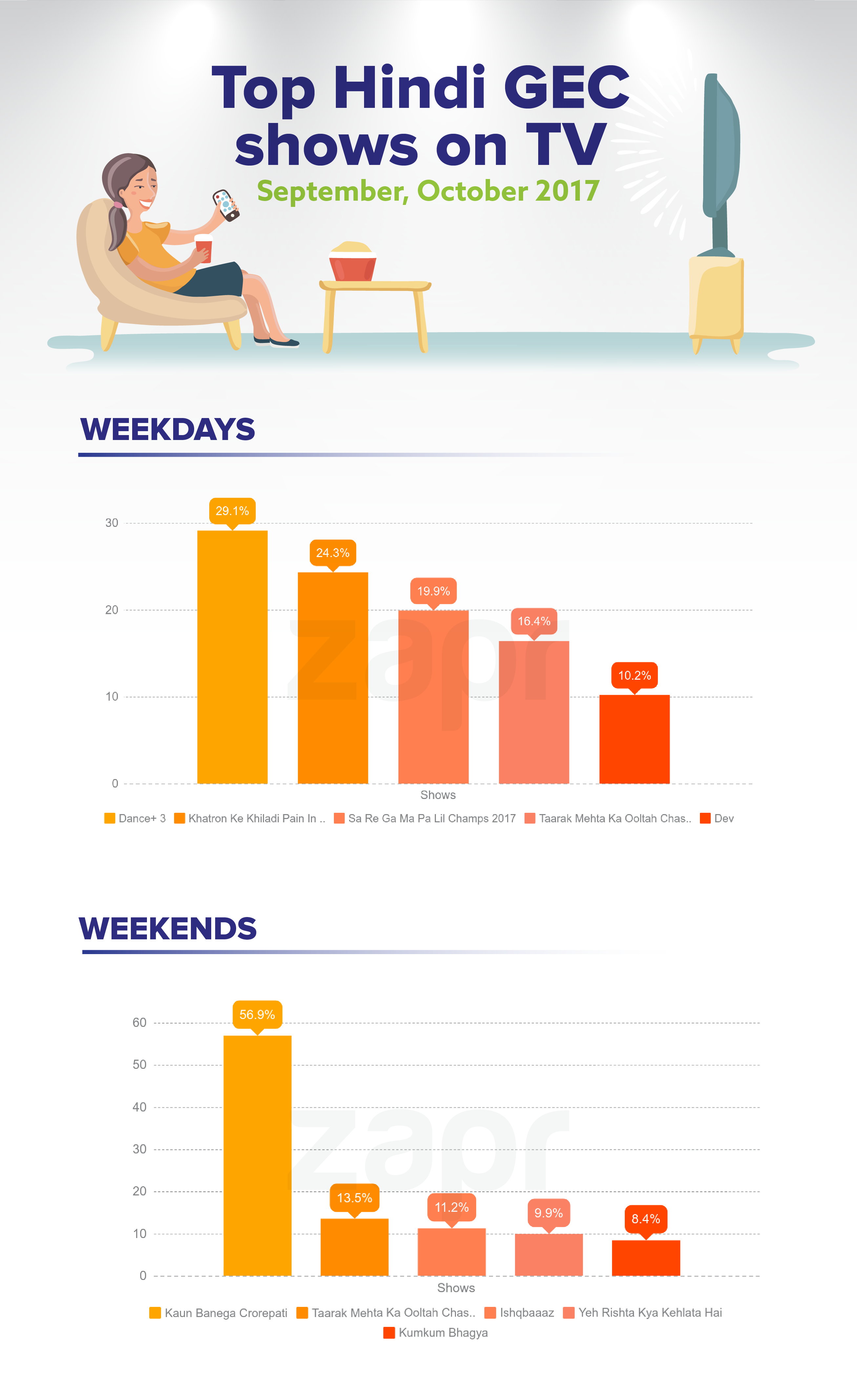

Let’s take a look at the shows which grabbed Top Five spots by viewership, across weekdays and weekends, in September and October this year:

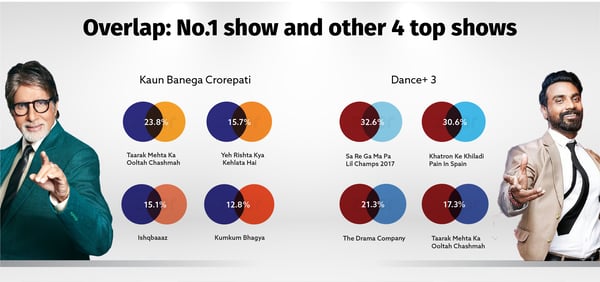

Next, we took the No.1 shows on weekdays and weekends and studied their overlaps with other top shows. This way we’d know how to reach the same audience segment whether they engaged with the No.1 show or No. 5 show, on weekdays or weekends.

Results reveal that the weekday No.1 Kaun Banega Crorepati, Sony TV’s favorite reality quiz show, had the highest overlap with Taarak Mehta Ka Ooltah Chashmah (23.80%), a popular sitcom with purely domestic narratives. While the weekend No. 1 Dance +3, a dance reality show on Star Plus, had the highest overlap with Zee TV’s music reality show Sa Re Ga Ma Pa Lil Champs (32.60%). Weekend shows had higher overlaps with each other compared to weekday shows, which means that viewers explored more of Hindi GEC content on weekends while they probably stuck to select shows on weekdays.

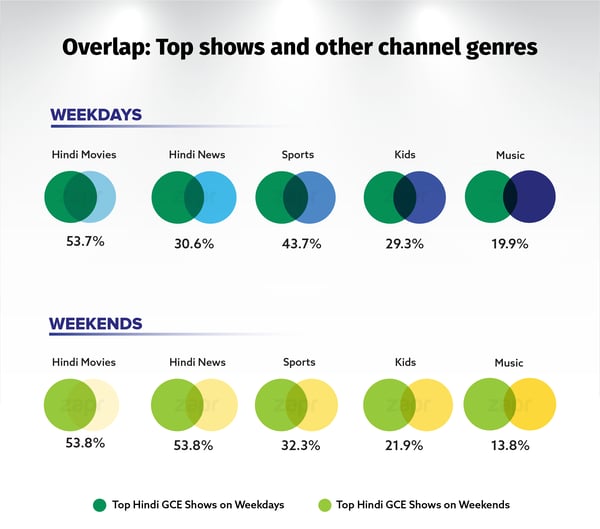

Furthermore, we tested their affinity for other genres and found different patterns for weekdays and weekends. Hindi GEC viewers watched more News on weekdays (43.70%) as compared to weekends (33.60%), whereas Hindi Movies received the same attention throughout. Similarly, Sports content received the same viewership while Kids and Music channels saw higher preference on weekdays.

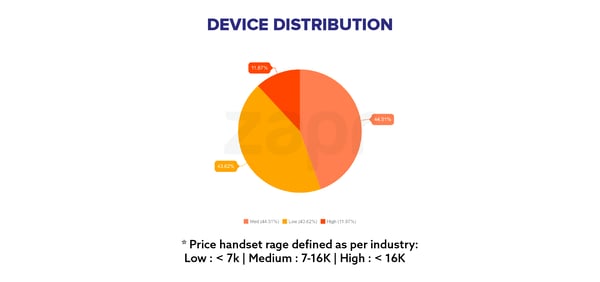

Our smartphone-powered technology also detected the kind of devices used by Top Hindi GEC viewers. We found that the spending power of Hindi GEC audiences reinforces their affinity for premium messaging since more than half of them possessed above-average priced phones: mid-end (44.52%) and high-end phones (11.87%).

For in-depth analysis on the actual geographic penetration of TV shows across both tier-1 and tier-2 cities, and other TV audience insights, marketers can reach out to us on hello@zapr.in. See how leading brands use Zapr’s TV-to-Mobile platform to analyze and precisely engage target audiences, click here.