India’s massive wins at the Asian Games 2018 not only created a whirlwind in the sporting world but also took the TV viewing landscape by storm.

With millions tuned in across both urban and rural audiences, Zapr analyzed the viewership trends and also studied if people switched channels to another major sports event aired live during the same time. Our data revealed interesting insights on how India watches sports on TV and how brand advertisers can reach them more effectively.

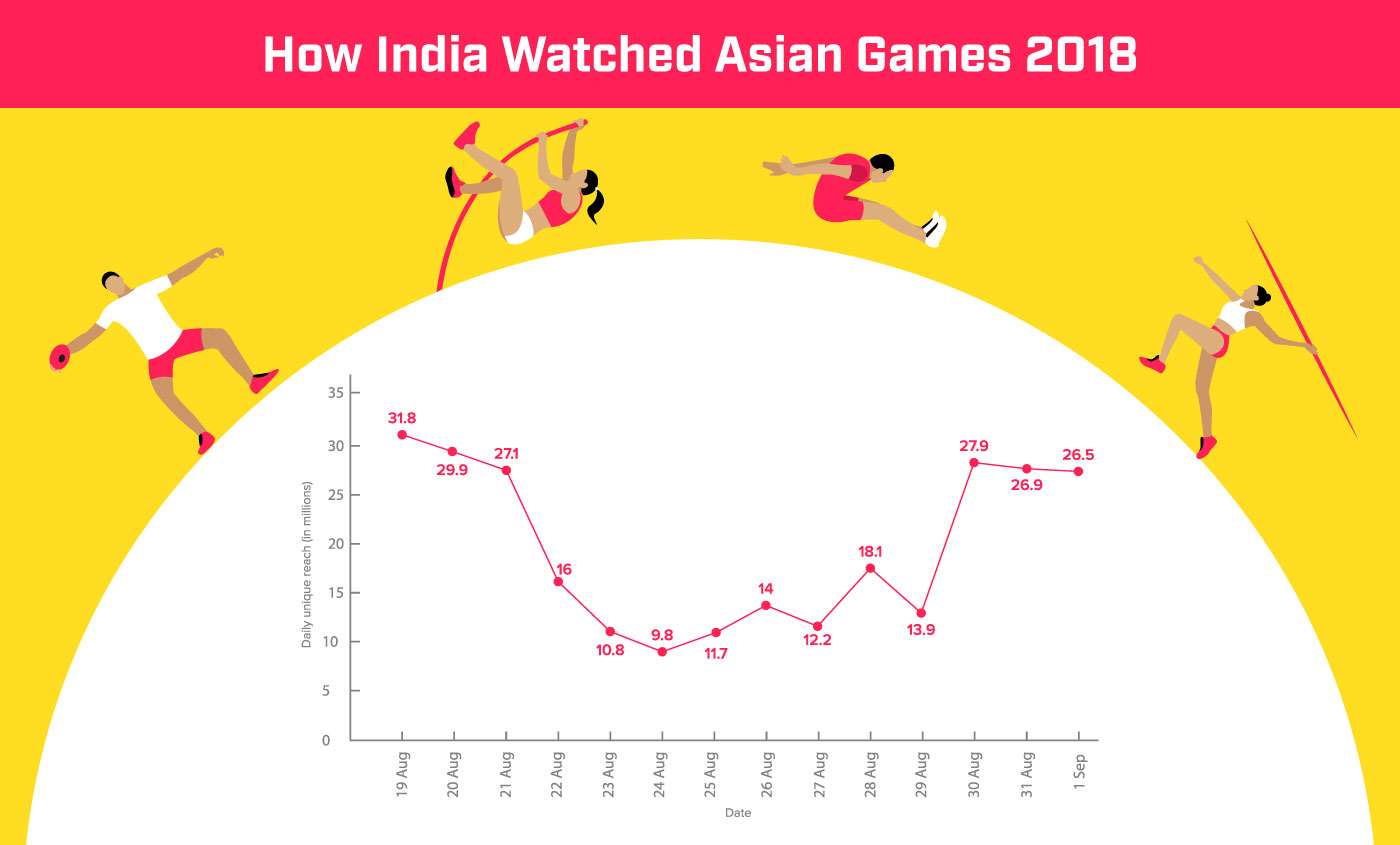

How India watched Asian Games 2018

The 2018 Asian Games opened on 19th August, with a record high reach of 31.8 million TV viewers. Interestingly, three days later on 22nd August, the numbers fell to 16 million, recording a drastic dip. The viewership kept decreasing until

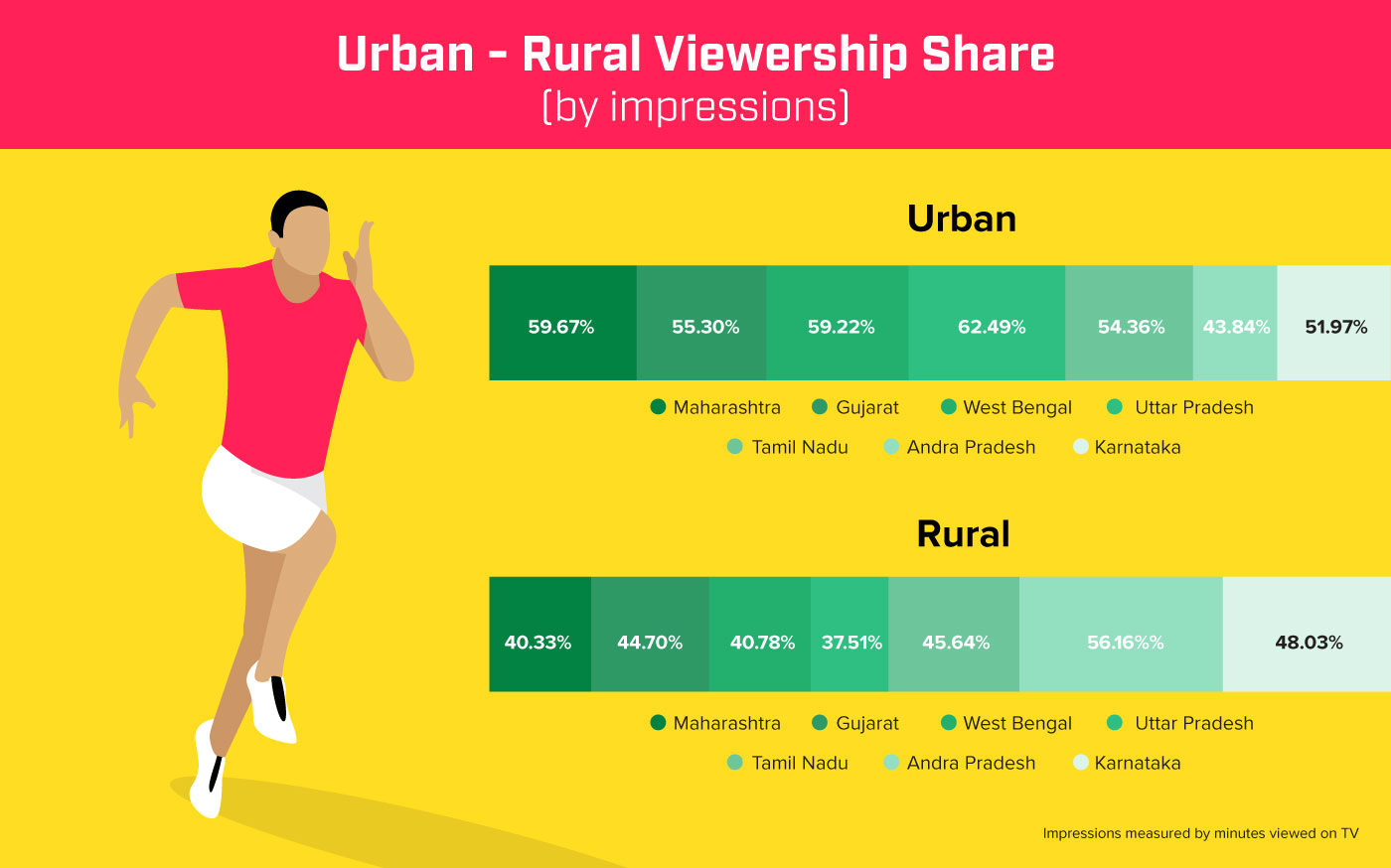

Urban-Rural Viewership Split

Zapr mapped audiences across different geographies and found that urban audiences had an edge over rural audiences by share of viewership. The only exception to this case was Andhra Pradesh where the urban audience share was 43.84% as opposed to the rural audience share of 56.16%. In Uttar Pradesh, a whopping 62.49% share was from the urban side while only 37.51 % was from the rural side. Among the rural audiences, Karnataka experienced the lowest viewership share at 5.61% and among the urban audiences, Uttar Pradesh experienced the lowest viewership share at 8.84%.

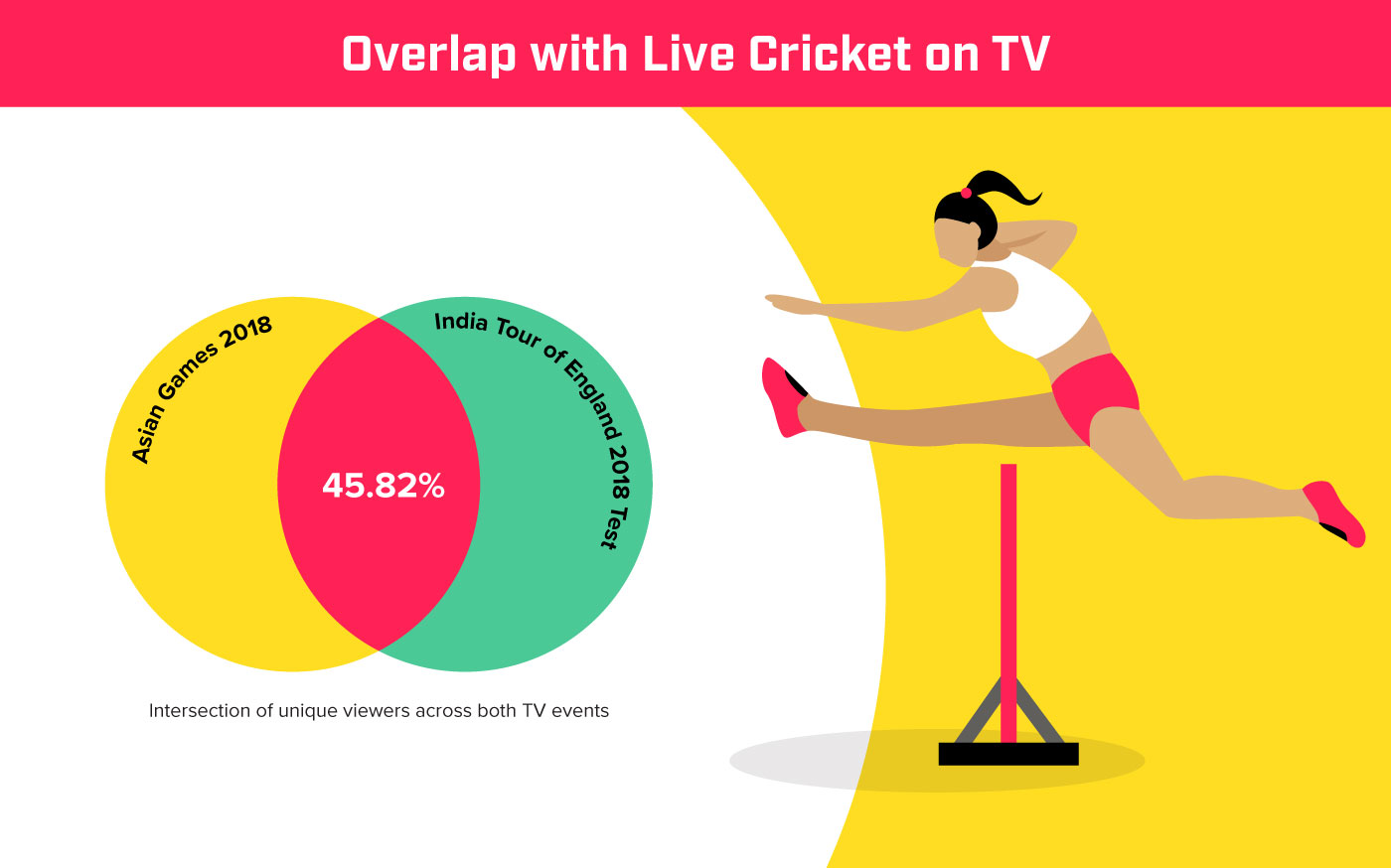

Asian Games viewers - What else did they watch?

We mapped out audience overlaps with migration from the ongoing 2018 India’s Tour of England to understand how people switched channels across two major televised sports events. We found that 45.82% of Asian Games viewers also tuned into India vs England test matches during the same time, revealing a huge chunk of core audiences whom brands could have reached by advertising on either one of the tournaments, without having to spend on all channels.

Brands and broadcasters can access deeper insights about audience content preferences, and even measure the