Homegrown football tournament ‘Indian Super League’ (ISL) commanded as high as 9.4 million viewers in a single day this season. With Ad revenues pegged to grow 25% higher from last year, the league has risen to become one of India’s biggest televised sports sensations. Given that brands spend millions on television inventory during popular sport broadcasts like ISL, how can we measure real impact from offline advertisement?

At Zapr Media Labs, we analyzed ads during ISL and mapped out audiences by content affinity and purchase power indicators. Following our previous analysis of how FIFA U-17 viewers migrated to ISL, we now measure the impact of brand advertisements on the opening night of India’s popular annual football league.

Top ISL advertisers: Can brands break free from the clutter?

Top advertisers for the opening night of ISL 2017-18 include brands from a variety of consumer sectors. However, the largest share of the ISL ad pie went to automobile brands such as Hero, Maruti Suzuki and Bajaj, followed by paints brands Lewis Berger and Wallmaax. Featuring on the Top 10 is leading technology brand Apple and logistics company DHL.

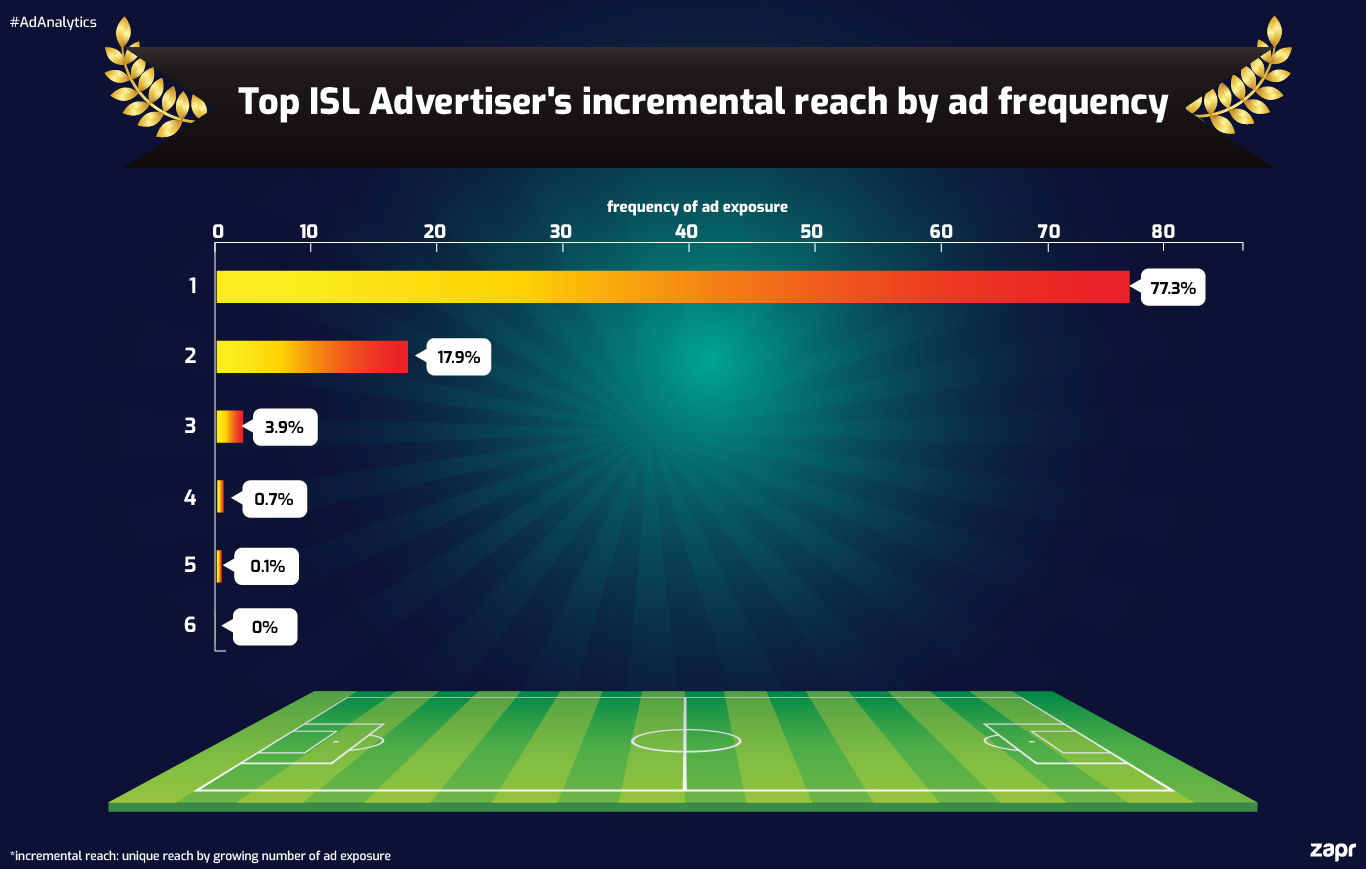

How can these brands win top-of-mind recall amidst the clutter of advertisers? Can they cut across direct competitors and even advertisers from other sectors? Zapr’s ad intelligence further broke down a top advertiser’s performance by measuring unique reach for every ad spot obtained:

In the chart above, we see that the brand’s incremental reach keeps diminishing with growing number of ad spots, meaning that heavy priced inventories are not making new hits.

Instead, brands can grab incremental reach or build frequency among the most relevant audiences by targeting priority TV markets straight on Mobile where users pay 84% higher attention to rich media ad content compared to broadcast TV.

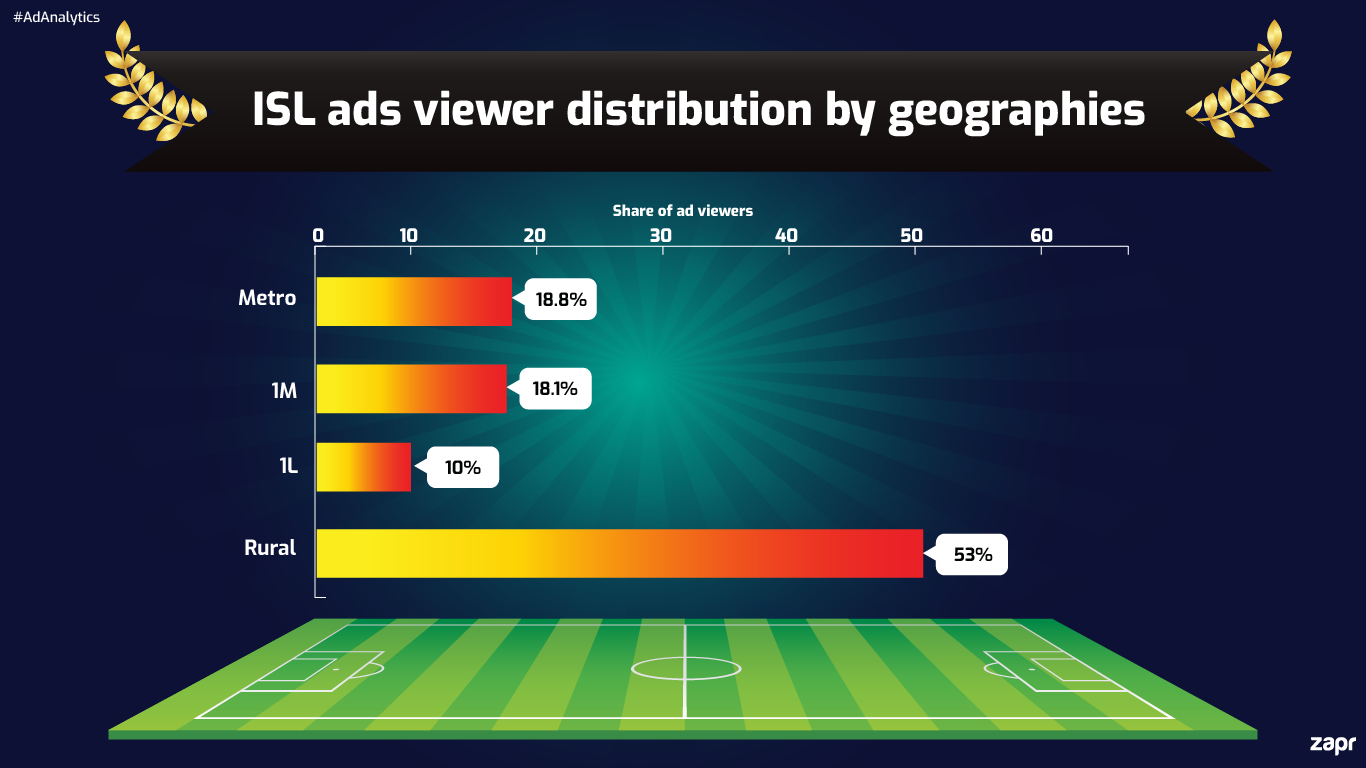

Can brands deterministically find their audiences across geographies?

To gain deterministic insights on how ads performed during the Indian Super League across India’s TV viewing population, we mapped out their real reach by geographies. We identified ad viewership among only active TV viewing populations. This gave us the real reach metric of ads across populations by eliminating all probabilistic factors while measuring ad performance.

Among urban populations, ISL ads had the highest share of viewers among metropolises (18.8%) such as Mumbai, Kolkata, Delhi and others. Cities with 1M population followed closely with 18.1% while the next 1L sector dropped drastically to 10%. Interestingly, ISL ads penetrated deeply into rural populations by a wide margin - 53% of ISL’s entire geographic reach.

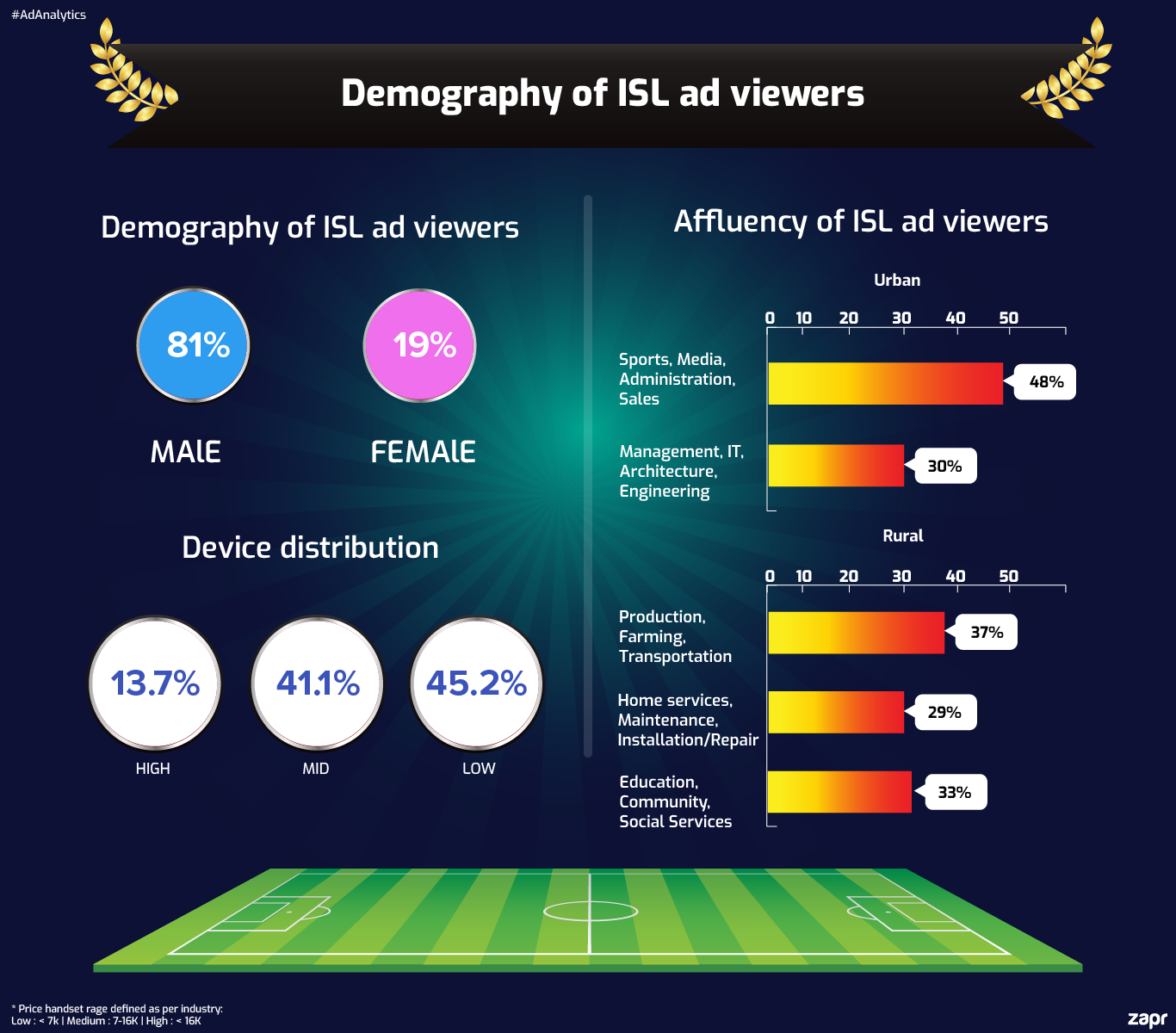

Next we delved into the demography of ad viewers to find out the kind of audiences impacted by ISL advertisers:

Age, gender and affluence indicators: Who did ISL ads speak to?

Zapr’s user-profiling technology found high skew towards male viewers (81%) for ISL ads suggesting high market match considering the bulk of automobile brands that advertised during the league.

To get a sense of purchase power reflected in socio-economic status, Zapr studied the occupations of ISL ad viewers split across urban and rural audiences:

Among urban viewers, we found that 48% were occupied in Sports, Media, Administration and Sales related jobs suggesting huge impact among both sports enthusiasts and media planners/buyers. Having succeeded in reaching the best of both worlds in just one day, the Indian Super League could very well be the perfect ground for further expanding lucrative sports business.

Among rural viewers, majority audiences had roles in Production, Farming, Transportation sectors (37%) followed by Home services, Maintenance, Installation/Repair (29%). Given the Indian rural market’s rapidly growing purchase-power coupled with high smartphone penetration, is it time for brands to create stronger rural strategies that smartly integrate digital with their deep-reaching TV campaigns?

Optimizing media plans: Where else are ISL audiences present?

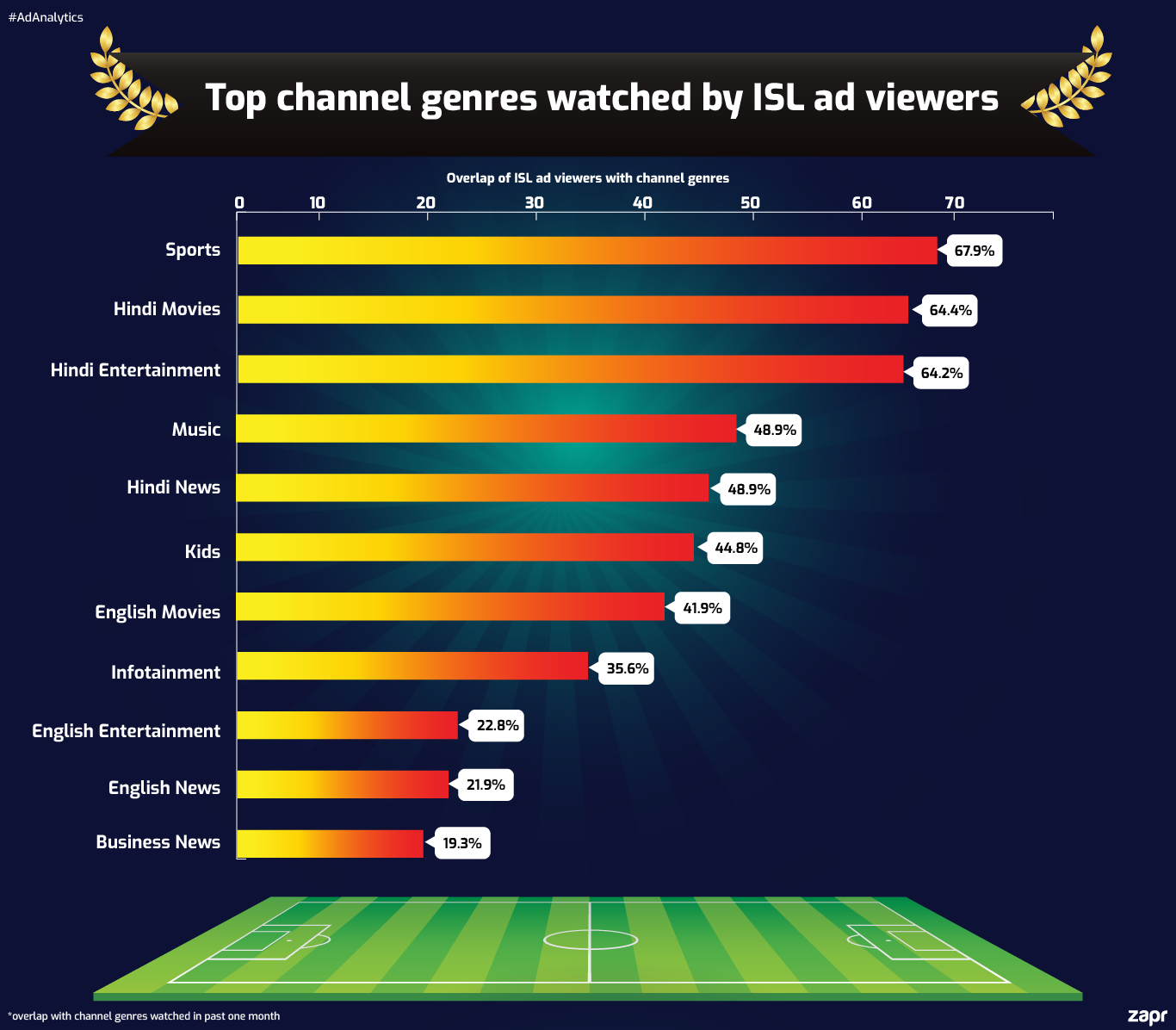

To meet advertisers’ need to optimize huge spends across their media mix, Zapr mapped out what ISL ad viewers watch on TV. This way brands can accurately identify the same individuals across other time slots, shows and channels, or reach them directly on mobile.

Our overlap analysis revealed that a large portion of ISL viewers watch Hindi channel genres - Movies (64.4%), General Entertainment (64.2%) and News (46.30%). Interestingly, we found high overlap with Music channels (48.9%) suggesting a highly youth populated audience exposed to ISL ads.

Our analysis revealed that significant portions of ISL ad viewers watched Business News (19.30%) and English channel genres such as Movies (41.90%), Infotainment (35.60%), Entertainment (22.80%) News (21.90%). This strongly suggests large presence of English-speaking, socially and economically upward audiences among those impacted by ISL TV ads.

Advertising during major sports leagues requires intelligent strategies that reach the masses without losing out on share-of-mind. Marketers can use Zapr ad analytics to determine their select markets using true media-consumption detection. Brands can convert their ROIs from offline to online media, without any spillover, by engaging audiences directly on mobile.

Subscribe to our newsletter to receive TV ad analytics pieces straight in your mailbox!