India houses the world’s second largest TV population comprised of 800 million active TV viewers across 200 million households. Measuring content performance at highly granular levels is crucial in understanding how to drive content strategies. More importantly, today’s multi-screen approach has made it possible for broadcasters to interact with TV audiences on mobile and other digital devices. This opens up ingenious ways of acquiring new viewers, building loyalty and improving content through instant feedback.

In the conventional way, TV consumption is measured by calculating impressions across a sample size of about 30,000 households. Final viewership numbers are arrived at through massive extrapolations which have high margins of error.

For the longest time, TV channel owners had to depend on this large “sample” data to understand how viewers watch their content. But now, ACR technology has enabled automatic detection of TV viewership among mobile users at nearly 100% accuracy rate. This opens up powerful real-time insights like never before, and makes it possible to directly engage with custom TV audiences on their phones based on consumption habits (example: genre lovers, competitor channel viewers, etc.)

We’re going to explore four major ways in which broadcasters can leverage granular insights of their TV audiences and also use cross-screen engagement to boost TV viewership:

A. TV viewership analytics of shows and channels

These are some of the ways in which any given audience can be analyzed in depth to provide granular insights on how content has performed across different geographies, channel genres, time-slots and so on.

1. Content performance, comparison with competition and audience TV viewing habits:

For selected genres / channels / shows, two major metrics are calculated: reach (how many people watched it) and impressions (how many times they watched it). The analysis becomes especially effective when direct comparisons are drawn with competitor channels and shows.

Moreover, overlap studies are also conducted to find a common set of viewers for two or more channels and shows. This helps broadcasters understand how much of one channel’s audiences are present on another, helping them to strategically place promos and even modify content to better suit viewers’ preferences.

2. Geographic level analysis to understand reach gap and plan corrective measures

We can identify towns/cities within a state which had lower reach compared to competitors. This is backed by studies of preferred time slots when people tune into TV, and also an analysis of how they switch channels. This helps broadcasters identify content which works better and also modify program line-up that suits audiences better.

3. Promo viewership analytics and conversion measurement

Broadcasters can measure the success of their promo videos (for a show or a televised event) by identifying how many people watched the promos and ultimately, how many of them converted into viewers of the show or event. The analysis is extended to understand the TV viewing habits of the newly converted audiences, to gauge their content preferences on the long run.

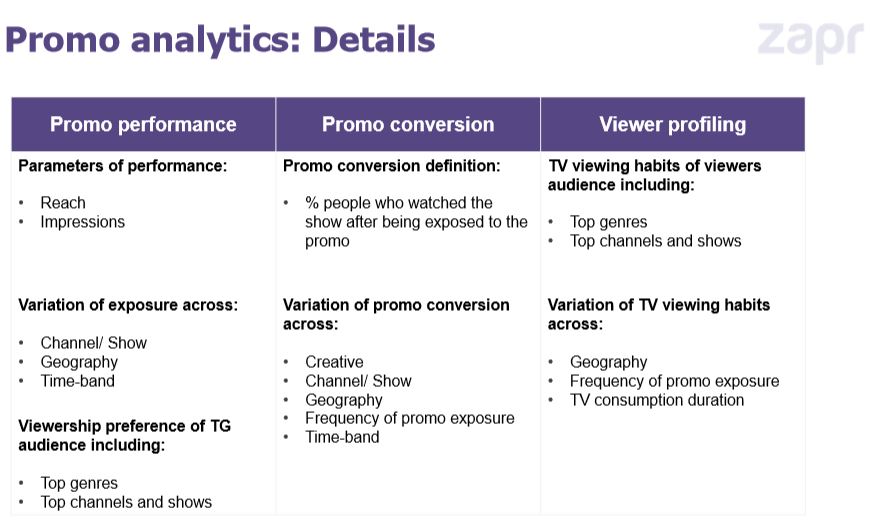

Here are all the possible data cuts for a promo analysis:

4. Lapser/Drop-out profiling: who stops watching a show/channel and why?

People who stop watching a show or channel a.k.a “dropouts” can be identified and profiled demographically (age, gender), and also by affluence levels based on the kind of phones they use (low, mid or high priced devices).

The next step is identifying key characteristics of their TV viewing behaviour such as the top shows, channels or genres they watch. A further analysis could reveal the primary and secondary languages they consume, giving insight into why their interests have shifted.

Ultimately, the reasons for dropping out can be explored by analyzing new content preferences. But even better, broadcasters can hear it straight from drop-outs by conducting mobile surveys asking them why they stopped watching their shows or channels!

B. TV-to-Mobile targeting to increase TV viewership

Airing promos on TV are a great way of getting existing TV audiences to watch a new show or a special event broadcast. But what about the rest of the people who don’t watch the channels in which they advertise? Second screen devices like mobile end up playing a huge role in getting new viewers or getting back ‘lost audiences', all the while ensuring that TV content stays strong in the minds of relevant TGs.

Accurately targeting viewers of specific shows and channels can lead to 3 types of benefits:

Acquiring new viewers

To acquire new viewers, broadcasters can execute genre based targeting and competitor audiences targeting. This means they digitally reach out to people who regularly watch other shows and channels in the same genre, or specifically their direct competitors. For example, one Hindi GEC channel could either target viewers of all Hindi GEC channels, or specifically engage with viewers of their biggest competitor channel(s).

Maintaining loyalty among existing audiences

To maintain loyalty for existing TV viewers, broadcasters can target channel viewers who have not watched their TV promos, directly on their phones. Research shows that 66% of average TV viewers watch a TV show after watching the promo online. They can also increase the frequency of exposure for those who already watched the promos, by showing it to them a couple more times. This ensures that their content stays fresh in people’s minds, and increases the chances of them tuning in.

Re-acquiring lapsers or drop-outs (those who stopped watching)

To re-acquire lapsers / drop-outs, we identify those who watched a particular show or channel regularly and then dropped out or switched to another show all of a sudden. These individuals are targeted with promos of the shows from which they dropped out, to give them a taste of what they’ve been missing.

Download the broadcaster case study package for TV-to-Mobile campaigns and learn how Star India aced the primetime TV battle and acquired 500,000+ new viewers for three new shows; or how Sony TV acquired 300,000+ new loyal TV viewers for a new dance reality show; and understand how Colors TV brought back show drop-outs and boosted viewership by 25%.

C. Target Audience Research: Know what works with your TV audiences

The best part about being able to individually identify TV viewers is that it becomes possible to engage with them directly. Using mobile surveys that are precise, instant and highly scalable.

Broadcasters can automatically identify viewers of a show or channel / drop-outs without needing to depend on secondary research which could take weeks or months, and instantly conduct surveys among millions of people within just a day. Further analysis is done to identify demographic details, working status and finer behavioural characteristics.

D. Strengthening niche channels value proposition

Niche channels are often underestimated owing to their smaller user bases compared to mass consumed channels like news. On one hand, there has been under-reporting of reach numbers owing to technical challenges of detecting TV consumption. But ACR detection has now made it possible to measure viewership with precision.

Tests have been done to showcase the following propositions which have hugely improved the value proposition for niche channels such as HD and English channels:

1) High income and better socio-economic conditions: the disposable income of HD subscribers is 3x that of SD subscribers, and ~60% of HD subscribers reside in India’s top 10 cities.

2) Exclusivity: 35% of HD viewers are light TV watchers, and when they do watch TV, they spend 1.7x more time on a show compared to viewers of other genres, which means they are highly exclusive and don't switch channels that often. English viewers spend only 15% time on Hindi shows/channels making them extremely difficult to reach them outside English channels.

This is only the tip of the iceberg for how broadcasters can leverage ACR driven analytics and cross-screen engagement. And we’re certainly not exaggerating when we say that. If you want similar insights for your channels or you’re interested to explore TV-to-mobile engagement, click the ‘Get In Touch’ button on top to speak to our team!